Who We Are

A culture of excellence

Since 1995, Palisade Capital Management has focused on providing investment solutions to institutions, individuals, and families to help them meet their long-term goals. As an investment manager of assets for several of the nation's largest companies and public institutions as well as hundreds of high-net-worth individuals and families, Palisade's extensive investment management, research, compliance, and legal resources are applied to each relationship. Palisade Capital Management is independently owned by our leadership, instilling a strong sense of accountability and responsibility for our success. As a result, we are particularly attuned to the significance of helping our clients endure and prosper.

We believe in working together, sharing ideas and information, and endeavoring as a team to further our clients' goals and objectives. This collaborative approach extends to our clients, with proactive engagement and dialogue to ensure we develop solutions that are tailored to each investor's needs.

Palisade's rich institutional history in individual security research and investment management for several of the nation's largest private companies and public institutions serves as the foundation of our firm. As professional investors who constantly monitor the economy, the markets, and macro trends and developments, we apply a deep level of rigor to each portfolio we manage.

We pride ourselves on the extensive experience of many of our professionals who will get to know you as more than just an investor. We also understand your need for accessibility and communication is not constrained from 9 to 5, and neither are we. Palisade's team is always available and encourages you to contact us at any time. Frequent communication on your investment portfolio and our thinking help ensure that you always know what you own — and why.

Palisade strongly believes in supporting the communities in which we live and work, with a commitment to giving back through mentoring, community service, sponsorships, and involvement.

Collaborative Mindset

We believe in working together, sharing ideas and information, and endeavoring as a team to further our clients' goals and objectives. This collaborative approach extends to our clients, with proactive engagement and dialogue to ensure we develop solutions that are tailored to each investor's needs.

Institutional Investment Management Legacy

Palisade's rich institutional history in individual security research and investment management for several of the nation's largest private companies and public institutions serves as the foundation of our firm. As professional investors who constantly monitor the economy, the markets, and macro trends and developments, we apply a deep level of rigor to each portfolio we manage.

Personalized Attentive Service

We pride ourselves on the extensive experience of many of our professionals who will get to know you as more than just an investor. We also understand your need for accessibility and communication is not constrained from 9 to 5, and neither are we. Palisade's team is always available and encourages you to contact us at any time. Frequent communication on your investment portfolio and our thinking help ensure that you always know what you own and why.

Community-Oriented

Palisade strongly believes in supporting the communities in which we live and work, with a commitment to giving back through mentoring, community service, sponsorships, and involvement.

As a fiduciary, we are held to a high standard, required to put your interests above ours and act in your best interest at all times.

Our commitment to diversity, equity, and inclusion

Palisade Capital Management believes we best serve our clients by taking a forward-looking perspective and encouraging a culture that is inclusive and diverse. Our clients and Palisade benefit from diverse viewpoints, beliefs, and backgrounds which we support through developing our professionals in a supportive and engaging way. Palisade Capital Management maintains a strong commitment to stand against discrimination in all its forms.

LEARN MORE ABOUT WORKING AT PALISADEOur History

Palisade Capital Management was founded in 1995 by brothers Martin L. Berman and Steven E. Berman, together with their long-time colleague, Jack Feiler. With substantial experience in senior leadership positions at major financial services institutions prior to founding Palisade, our three founders knew there was a better way to help institutions and wealthy families achieve their investment goals and bring strategy, structure, and organization to their financial objectives. Senior Partner and Chief Investment Officer Dennison “Dan” T. Veru worked with Palisade's founders from 1986 to 1992 and joined Palisade in 2000. Alison A. Berman joined Palisade in 2011, holding various positions until her promotion to President and Chief Executive Officer upon Martin Berman's passing in 2018.

In 2023, as part our strategic plan for growth and evolution, Palisade added nine new employee equity partners and became a WBENC-Certified Women's Business Enterprise, representing the firm's commitment to diversity, equity, and inclusion.

As a fiduciary, Palisade's approach to wealth and investment management has remained constant for over 30 years. We strive to put clients' interests first, deliver solutions customized to clients' unique goals and circumstances, and aim to provide an unparalleled level of service from a dedicated team of experienced professionals. Today, Palisade's Operating Committee and senior management team continue to emphasize our core investment approach as we strive to think, invest, and treat our clients in a manner that is fundamentally different from other asset managers.

.jpg)

.jpg)

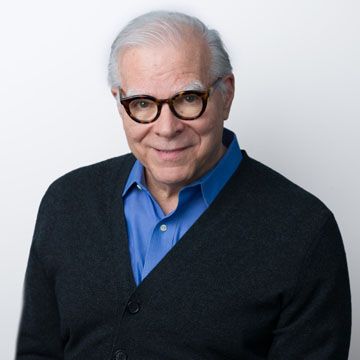

About Our Founder

Martin L. Berman was the driving force behind Palisade and started the firm in 1995 with the vision of serving institutional and individual clients with a disciplined investment management approach combined with personalized, high-touch service.

With Marty's passing in 2018, Palisade lost an inspired leader and a great friend. Marty cultivated a collegial environment where both clients and employees are part of the Palisade family, and he worked tirelessly to provide firm clients with unparalleled service. Marty was also dedicated to ensuring Palisade would sustain and prosper in the future, and his legacy continues today under the leadership of Palisade's Managing Partner, President and Chief Executive Officer Alison Berman.

In Memoriam

With deep sadness, we share the news of the tragic passing of our Partner and dear friend, Frank O. Galdi.

Our thoughts and prayers are with Frank's family—especially his wife, Angie, and his daughters, Olivia and Christina—as well as Frank's extended family, many of whom we have come to know over the years. Frank was not only a respected leader at Palisade, but also a trusted colleague and dear friend whose impact on our firm and culture will be felt for years to come.

Frank was a valued member of Palisade's team for more than a decade. Although he had recently been on personal leave from the firm, Frank's contributions since joining Palisade in 2014 were significant. Frank was a mentor to many, a thoughtful and dedicated professional, and a colleague who consistently held himself and those around him to the highest standards. He worked tirelessly on behalf of the firm and its clients and had a remarkable ability to connect with people with warmth, humility, and sincerity.

Frank's career reflected both intellectual rigor and deep integrity. He earned his M.B.A. in Finance and his B.A. in Accounting from the Lubin School of Business at Pace University. He began his career at Metropolitan Life Insurance Company before joining Bear Stearns & Co., where he became a Managing Director and Principal. He later joined New York Life Insurance Company's wealth management division, serving in senior leadership roles including Vice President, Head of Investment Strategy and Risk Management, and Chairman of the Investment Committee, with responsibility for risk oversight and investment due diligence.

Frank initially joined Palisade as Chief Risk Officer and was subsequently named Deputy Chief Investment Officer. In recognition of his leadership and meaningful contributions, he became a Partner in 2023 as part of Palisade's first class of new equity holders since the firm's founding in 1995. At Palisade, Frank had overall responsibility for the firm's risk management framework, performance measurement and analytics, and due diligence related to new investment strategies and strategic initiatives. We remain committed to serving our clients with the same care, discipline, and integrity that Frank exemplified throughout his career. For those who wish to share condolences or memories of Frank, we have established a dedicated email address at condolences@palcap.com.